Thank you Lexington Law Firm for sponsoring this post. A high service partner and consumer advocate that will help you fight for the credit you deserve!

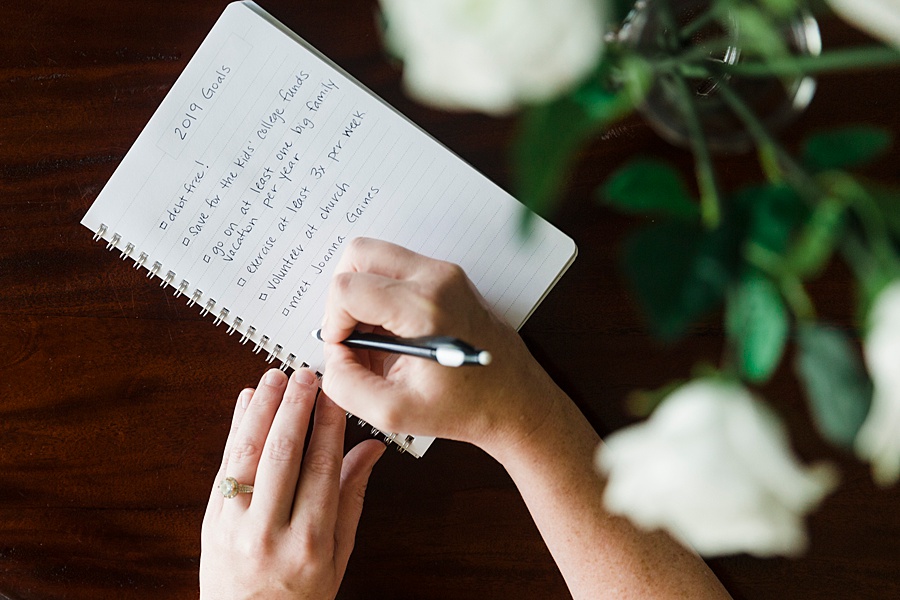

Do you set goals monthly? My husband and I started doing this and it’s been such a great way for us to keep our futures aligned and our money going where it should be. I don’t know if you know this, but money really doesn’t grow on trees (so I guess my dad was right). So it’s been a great way to know how to manage our money and set our budget for future plans and expenses.

I remember when I got my first job, my mom insisted that I get a credit card. Now, this didn’t mean that she was allowing me to get whatever I wanted. Oh no, it was more for me to be able to get groceries for them or gas or that sort of thing. It had a $500 limit and I felt like the coolest 16 year old in the world. But why would she give something so powerful to a teenager? One reason – credit. You see, she is a CPA, so she knows the value of having credit and how building it (and keeping it) can make or break your future plans.

Stages of Credit

Not everyone will go through them, but when it comes to credit, there’s 5 stages:

- Building it

- Keeping your spending in check

- Becoming a victim of identity theft

- Repairing your credit score

- Being proactive in checking your score yearly

Apparently, identity theft is more common than you might think. We check our credit score every 6 months and this last time, there were two huge accounts with charge offs and non-payments that were not ours. It’s a helpless feeling looking at your financial report and seeing so many digits in debt that you didn’t even get the fun of racking up! Fortunately, we were able to get the accounts cleared up and removed from our credit history, but I know it’s not always that easy.

Repairing Your Credit

Repairing your credit is no joke. These are some common reasons why people have a low credit score:

- Divorce

- Medical bills

- Student loans

- They were on military deployment

- Victim of identity theft

The credit repair industry has grown a lot in the last 10 years, so it’s more important than ever that people educate themselves on what’s true and what’s not on credit reports and what can and need to be fixed.

Companies like Lexington Law Firm help people repair their credit scores when these major life events happen and can also help you build credit so you can build you dream home, save for retirement, etc. Sometimes, you just need to get a professional involved who knows the system and how to get you set on the right track as quickly as possible. Improving your credit score may take some time, but it can be done. Everyone has the right to good credit and achieving the goals they’ve set for themselves.

Lexington Law Firm is affordable too! With packages that start at just $24.95 per month, they can help you get your credit back on track – and base your service on your specific needs. They also have long-standing relationships with Equifax, Experian, and TransUnion, so they know how these credit reporting agencies work and how to resolve the issues on your credit the most effectively.

If you’d like to see more information on Lexington Law Firm, go here.